Fidelity’s director of global macro Jurrien Timmer is updating his outlook on Bitcoin (BTC) as the leading crypto asset by market cap struggles near the $20,000 level.

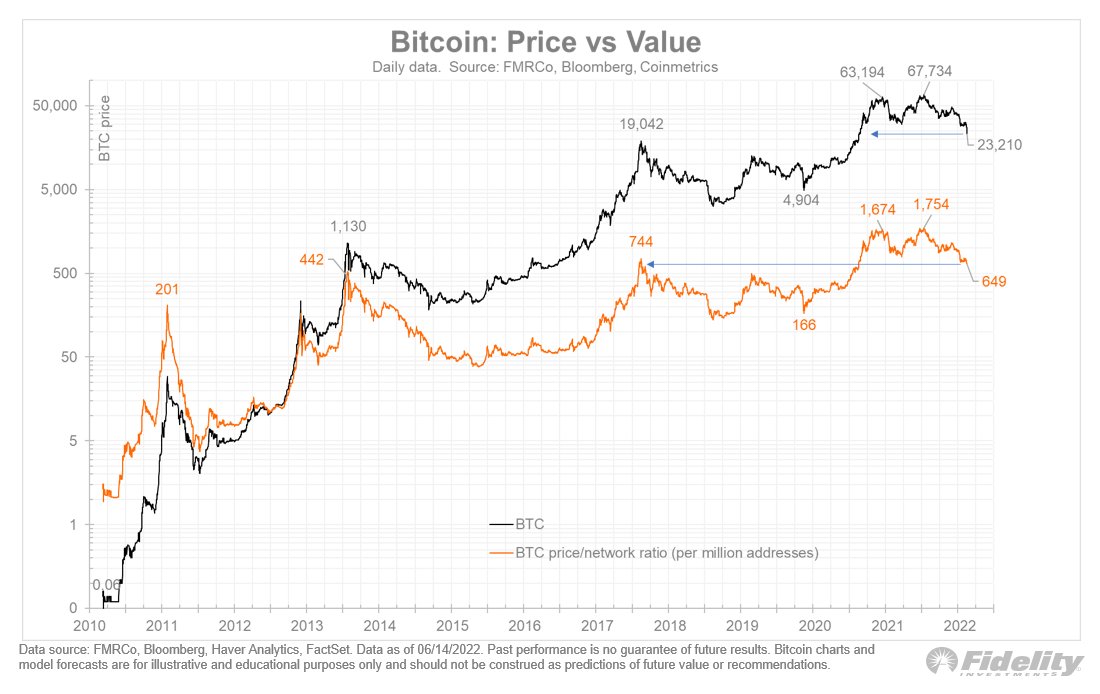

Timmer tells his 126,000 Twitter followers that when considering Bitcoin’s “P/E” (price to earnings), a metric traditionally used to value stocks by comparing the company’s earnings with its stock price, BTC is currently significantly undervalued.

The analyst compares the earnings of a company to the number of users on the Bitcoin network.

“Is BTC cheaper than it looks? If we consider a simple ‘[price to earnings]’ metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. Valuation often is more important than price.”

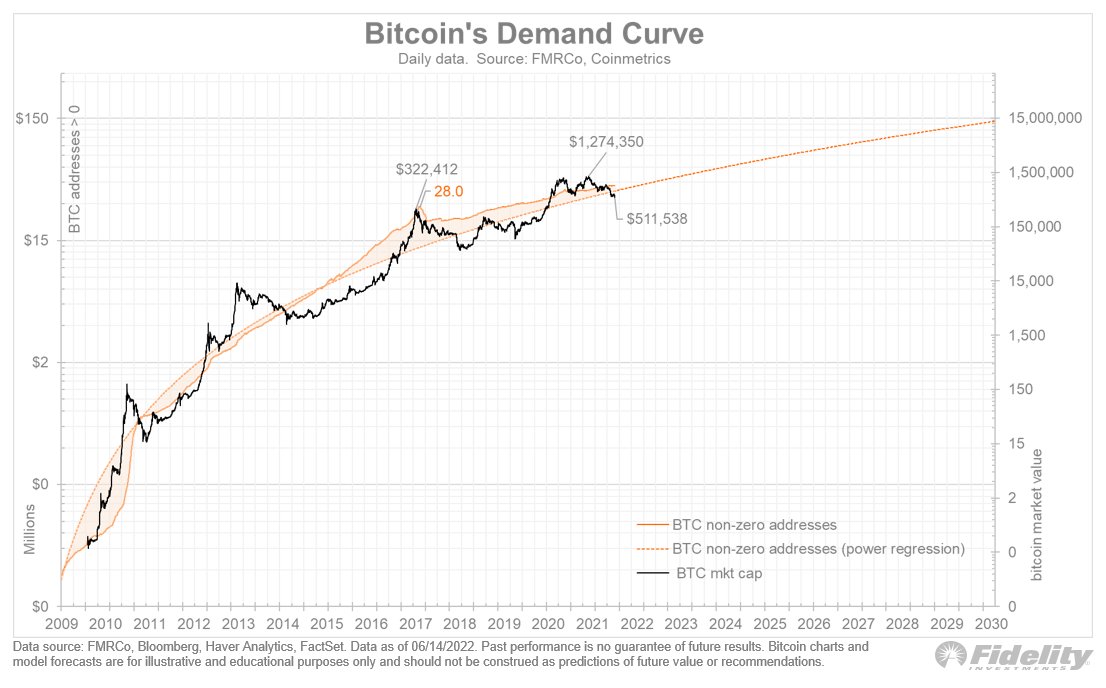

In similar fashion, Timmer uses a metric that records the number of non-zero Bitcoin addresses with the price of BTC. Historically, price has fluctuated above and below the demand curve.

“Another way to highlight this is by overlaying Bitcoin’s non-zero addresses against its price. Price is now below the network curve.”

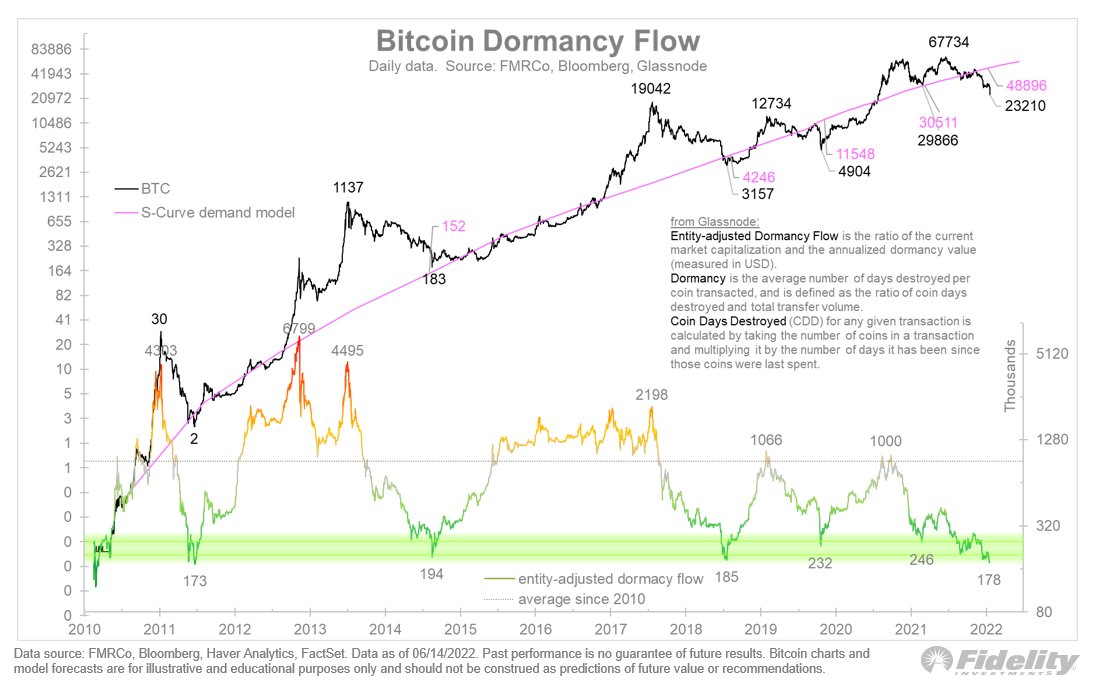

The macro analyst also takes a look at Bitcoin’s dormancy flow, which measures the average number of days that coins have remained untouched. Based on Timmer’s interpretation of the historical track record of the metric, Bitcoin’s dormancy flow is at levels not seen in over a decade, before BTC went on parabolic rallies.

“The next chart shows how technically oversold Bitcoin is. Glassnode’s dormancy flow indicator is now to levels not seen since 2011.”

Check Price Action

Don't Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/YUCALORA

The post Top Fidelity Macro Analyst Says Bitcoin (BTC) Way Oversold as Key On-Chain Metric Reaches 2011 Levels appeared first on The Daily Hodl.

source https://dailyhodl.com/2022/06/15/top-fidelity-macro-analyst-says-bitcoin-btc-way-oversold-as-key-on-chain-metric-reaches-2011-levels/