Analytics firm Santiment is weighing in on the state of Bitcoin and Ethereum as investors wait for the crypto markets to make their next move after a modest bounce in recent days.

Santiment highlights two metrics that suggest Ethereum could be at a better-than-average spot for long trades.

The first one is the market value to realized value (MVRV) metric, which divides a coin’s market capitalization by its realized capitalization to reveal the average profit/loss of all coins currently in circulation according to the current price. According to Santiment, the 30-day MVRV is hovering at a level that offers a solid risk to reward ratio.

“Historically, an average MVRV (30d) of -16.9% implies a less risky opportunity to buy than normal.”

Santiment also spotlights Ethereum’s weighted social sentiment which they say is flashing a signal that could be favorable to dip buyers.

“The crowd sentiment toward Ethereum is historically low now, a great potential opportunity to buy against the masses.”

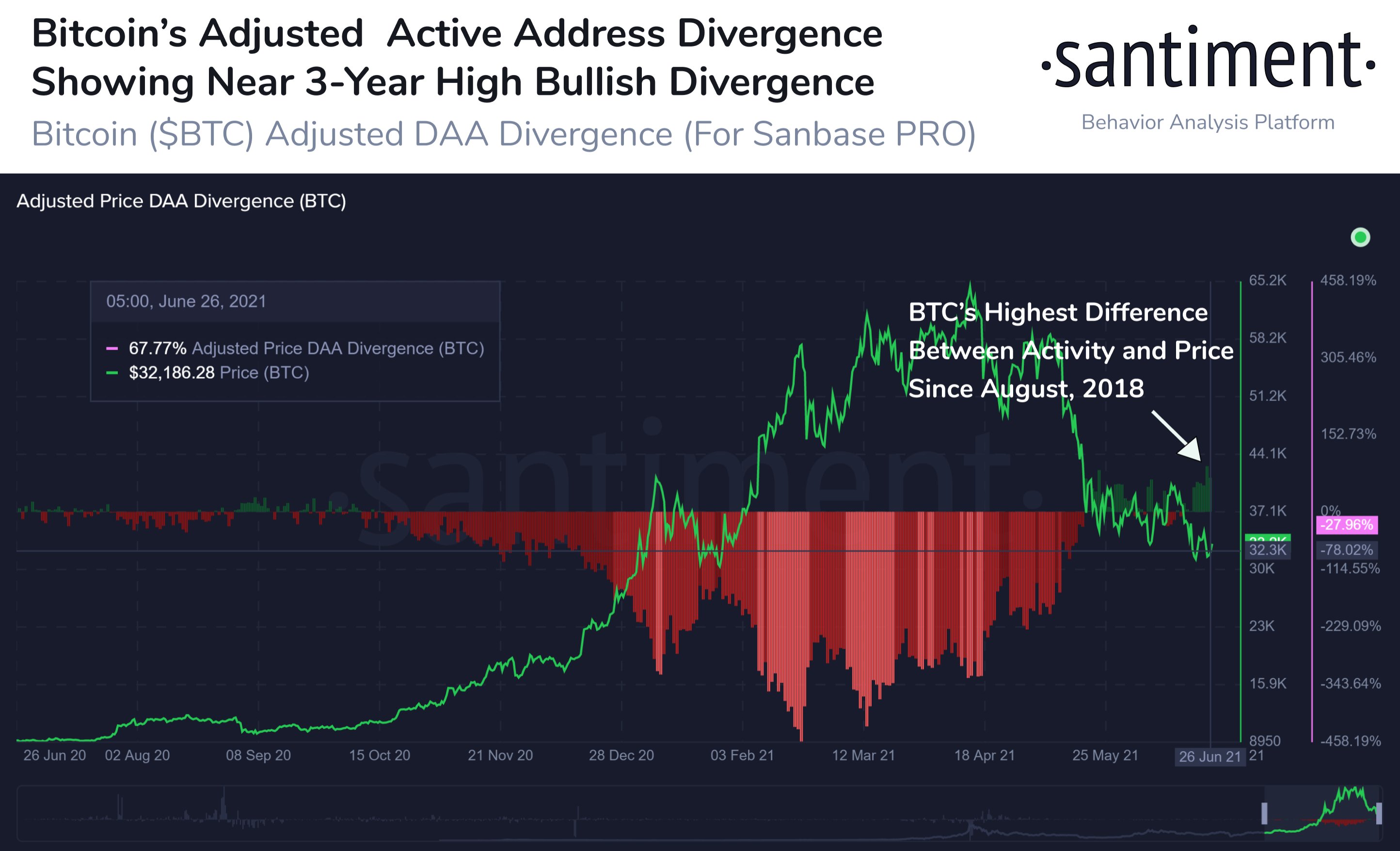

As for Bitcoin, the crypto insights platform says the leading cryptocurrency continues to show signs of strength in terms of on-chain fundamentals.

“Bitcoin is rebounding again, and active addresses are growing slightly following the massive 50%+ drop from the April all-time high. Our Active Address Divergence model shows that though a price drop made sense, address activity hasn’t dropped as much.”

The crypto analytics firm is also looking at the average return of Bitcoin traders, which they say has dropped to a level not seen since the coronavirus-induced crash in March 2020.

“Bitcoin may still be up significantly compared to 2020 prices. But through all of the FOMO (fear of missing out), top-buying and bottom-selling, the BTC network is at its lowest average trader returns in 14 months. This, historically, is a better than average spot to buy.”

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Ahmed Muntasir

The post Analytics Firm Santiment Weighs In on State of Bitcoin and Ethereum Amid Crypto Market Bounce appeared first on The Daily Hodl.

source https://dailyhodl.com/2021/06/29/analytics-firm-santiment-weighs-in-on-state-bitcoin-and-ethereum-amid-crypto-market-bounce/